The beginning of the Russia-Ukraine war on February 24 last year has brought about significant changes in the global economic scenario while affecting India’s trade partners as well.

Russia, which was ranked 25th among India’s trade allies in 2021-22, climbed to the 5th position in 2022-23, a significant rise of 20 spots within a span of one year. In the fiscal year 2022, Russia’s share in India’s total trade was only 1.27%, which increased to 4.24% in the fiscal year gone by, representing a growth of over three times.

In absolute terms, merchandise trade between the time-tested friends has jumped by over 276% to US$49.36 billion (in 2022-23) from US$13.12 billion a year earlier.

While climbing up the ladder, it has left behind some of India’s old trade partners, including Indonesia, Iraq, and Singapore among others.

Russia’s rapid stride on India’s trade charts has not gone unnoticed in the Western Capitals including the NATO bloc which is backing Ukraine “against an unprovoked war of aggression” by Moscow. There is growing pressure, both direct and indirect, on New Delhi to discontinue its reliance on inexpensive Russian imports, mainly oil, and align with the economic embargo imposed by the West.

Though, it is in the domain of imports, mainly oil, where the impact of Russian entry is felt more positively and profoundly.

According to the latest trade figures, India witnessed a remarkable rise in goods imports by over 368% from the Vladimir Putin-ruled country last fiscal compared to a year earlier. In absolute terms, India imported goods worth US$46.21 billion during the last fiscal year, a substantial rise from US$9.87 billion in FY 2022.

During the fiscal year 2021-22, Russia held the 19th position among the nations from which India imported goods.

However, in 2022-23, Russia experienced a significant leap, securing the 4th position in India’s import rankings, closely trailing behind China, the UAE, and the USA.

Exports though have not kept the same pace. In 2021-22, India’s merchandise exports to Russia were valued at US$3.25 billion which came down slightly to US$3.14 billion in the last financial year.

This import bonhomie has also led to the ballooning of India’s trade deficit, a concern Moscow is well aware of and is ready to address.

In the last fiscal, we had a trade deficit of over US$43.06 billion with Russia; this number was next only to China with which India had a negative trade balance of a little over US$83.12 billion, as per the latest Department of Commerce figures. The imbalance was US$6.61 billion in fiscal 2021-22.

According to a November report by Reuters, Russia was considering the import of over 500 products from India for crucial sectors such as cars, aircraft, and trains. This move was prompted by Western sanctions, which have reportedly hampered Russia’s ability to sustain its core industries. In December, India announced that it had shared a list of Indian products with Moscow, aiming to gain access to Russian markets.

With the outbreak of war last year, the Western nations in a synchronised move slowly started pressuring Moscow with sanctions in order to limit its access to money.

The European Union (EU) implemented a cessation of Russian coal imports and imposed a ban on the importation of refined oil. Additionally, both the US and the UK enforced a comprehensive embargo on all imports of Russian oil and gas.

In November 2021, i.e., two months before the war broke out, about 60% of Russia’s oil exports went to OECD Europe, and another 20% to China, according to the International Energy Agency (IEA). EU countries like Finland (80%), Lithuania (83%), Poland (58%), Slovak Republic (74%), etc, at the time, remained badly dependent on Russian oil for their energy needs.

Even at the start of 2022, deliveries to the EU comprised nearly half of Russia’s oil exports. However, the imposition of these bans resulted in significant shifts in trade patterns throughout the year. Russia needed money to fund its war, while energy-deficit countries like India needed cheaper oil to fuel their growth and economic ambitions.

In December last year, the anti-Russia coalition further intensified its measures by implementing a price cap of US$60 per barrel on Russian crude oil.

India has been stoutly resisting Western pressure and defending its move on buying cheaper Russian crude.

Justifying New Delhi’s position in Washington, External Affairs Minister (EAM) S Jaishankar in April last year had said that “…probably our total purchases for the month would be less than what Europe does in an afternoon.”

Union Finance Minister Nirmala Sitharaman too had defended the move saying “India’s overall interest” is what is behind the decision to buy discounted crude oil from Russia. “I would put my country’s national interest first, and I would put my energy security first. If there is fuel available and available at a discount, why shouldn’t I buy it? I need it for my people, so we have already started purchasing,” Sitharaman had said at India Business Leader Awards, organised by CNBC-TV18 in April last year.

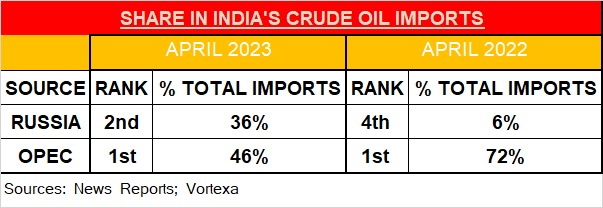

In between, Russia’s share in India’s crude oil imports went up from 0.2% of all oil imported in the year up to March 31, 2022, to 22% in October 2022, and further escalating to 36% in April 2023, according to data by energy cargo tracker Vortexa.

Conversely, India’s crude imports from the Organization of the Petroleum Exporting Countries (OPEC) cartel plummeted to an all-time low of 46% last month, dropping from 72% in April the previous year.

Besides, powered by cheaper Russian crude and its refining prowess, India has become one of the largest exporters of refined fuels like diesel and jet fuels to European nations. Recently, responding to EU foreign policy chief Josep Borrell’s call for a crackdown on imports of Indian-refined oil with Russian origins, EAM Jaishankar said: “Look at the EU Council regulations. Russian crude is substantially transformed in the third country and not treated as Russian anymore.”

Back home, cheaper Russian crude has also alleviated the fragile Indian economy, which is still recovering from the pandemic-induced slowdown. Over the past year, the retail prices of petrol and diesel have remained unchanged. The last revision in fuel prices occurred on May 22, 2022, when the Narendra Modi government announced a significant reduction of Rs 8 per litre in excise duty on petrol and Rs 6 per litre on diesel.

Besides, it is also helping to cool down inflation as India’s retail inflation eased to an 18-month low of 4.7% last month.

As a developing country and the third-largest oil importer and consumer, India relies on imports for over 80% of its crude oil needs and cannot afford to ignore discounted energy.